DWB is The Central Bank of the Balkan Federation

The DWB (Development World Bank) serves as the pivotal central bank for the Balkan Federation. Pioneering in its approach, it is the inaugural central bank to embrace digital currency as the foundation of its global monetary system. The adoption of digital currency by the DWB (Development World Bank) as the primary monetary system signifies a revolutionary shift towards a more accessible, transparent, and efficient financial landscape for the Balkan Federation and Africa. This innovative move not only positions the Federation at the forefront of global financial evolution but also promises greater financial inclusion, swifter transactions, and reduced costs for the populace, ushering in a new era of economic empowerment and opportunities for its citizens.

Also the First Digital

Central Bank of the world

The DWB (Development World Bank) stands as a monumental institution in the financial landscape, serving as the Central Bank for the Balkan Federation. What elevates its significance even further is its pioneering approach: DWB holds the distinction of being the world’s first central bank to adopt and operate on a digital currency system fully. This groundbreaking move underscores its innovative spirit and positions it at the forefront of modern banking, setting a global precedent for future financial plans.

New Monetary Cooperation

Backed by Gold, Commodities, and National Project Developments

A central bank backed by gold, commodities, and national project development of its member nations, operating under a federation structure, represents a powerful financial institution in the global economy. Welcome to the Development World Bank, the DWB.

The DWB is backed by tangible assets – gold and other commodities. Gold has traditionally been a store of value and a hedge against inflation. Other commodities serve as a store of value and provide economic security. The solid and stable backing for the bank’s monetary operations, lends credibility and trustworthiness in the eyes of other financial institutions and the public.

The backing from national project development is particularly innovative. The value of the currency or financial instruments issued by the central bank is backed by the value generated by the member nations’ development projects. This can range from infrastructure projects like roads and bridges, technology and innovation projects, and social development initiatives. This backing would mean that the value of the bank’s currency or financial instruments is intrinsically linked to the real-world value generated by these projects.

The joint operation and participation involve a high degree of cooperation and coordination among member nations and ideally distribute the power and benefits of the bank equitably among them. Now, even a developping nation has the power to leverage its membership with the Balkan Federation to quickly get ups on its feet.

The DWB enjoys an effective governance structures and a high level of transparency and accountability. The federation’s central bank represents a new model for international monetary cooperation, providing robust, tangible backing for its operations and fostering sustainable development among its member nations.

Article 5 of the Anti-Corruption Law of the Defense Protocol:

The misuse of public funds is “ACT OF TREASON.” Crimes committed against the population and humanity of Bulgaria by misusing public funds and deemed detrimental to the state’s interest and moral standard are considered an “act of treason.” The state reserves the right to revoke governmental, political, or diplomatic status. It will withdraw or cancel individuals’ official positions or privileges in those roles. When convicted of diverting funds from the country and therefore considered an “Act of Treason,” it will reserve the highest penalty. The presidential leadership and the advocates of the nation’s principles determine the specific definition and punishment for treason, including loss of citizenship, deprivation of all diplomatic and governmental status, and much more.

First Digital World Banking

The First Development World Bank (DWB), founded by President Mason, is now the “First Digital World Banking” system. President Mason’s proposal to establish the Development World Bank (DWB) as a digital banking platform with a universal digital currency, the Mason Coin, presents an exciting vision of financial inclusion and economic growth for Bulgaria and the broader Balkan Federation. Here’s how this approach could potentially work:

Financial Inclusion: The digital banking platform is designed to be easily accessible, even for remote areas or those currently underserved by the traditional banking system. This could include user-friendly mobile apps, low-cost transactions, and support for multiple languages.

Universal Digital Currency: The Mason Coin will facilitate easy and efficient transactions internationally within the Balkan Federation. It could also reduce transaction costs and provide more transparent and traceable transactions.

Economic Stimulus: The DWB will stimulate economic activity and growth by giving all citizens access to banking services. It could also provide loans or grants to businesses and individuals, helping to encourage investment and job creation.

Education and Support: The DWB could also offer educational resources and support services to help citizens make the most of these new financial opportunities. This will include financial literacy programs, business planning tools, and customer service support.

Regulation and Security: To ensure the safety and stability of Mason Coin and the digital banking platform, robust regulatory frameworks and security measures are implemented. It includes everything from encryption and cybersecurity to financial regulations and customer protections.

President Mason’s vision of a digital banking platform with a universal coin brings a wide range of benefits to the citizens of Bulgaria and the Balkan Federation, including greater financial inclusion, more efficient transactions, and increased economic activity.

Groundbreaking Operation

Establishing the Mason Coin as the first digital currency system adopted by a central bank was a groundbreaking moment in financial history. Here is the operation’s outline:

Central Bank Digital Currency (CBDC): The central bank adopting a digital currency would essentially be issuing a Central Bank Digital Currency (CBDC) (the Mason Coin). A CBDC would be a digital form of the nation’s sovereign currency, issued and regulated by the DWB central bank.

Legitimacy and Stability: A digital currency backed by a central bank automatically has a higher degree of legitimacy and stability than many existing systems that no government or central authority supports. This backing provides a solid foundation for the Mason Coin, increasing trust and potentially encouraging wider adoption.

Monetary Policy: The central bank uses the Mason Coin as a new tool for implementing monetary policy. For instance, it will control the supply of Mason Coin to influence interest rates, manage inflation, and stimulate economic growth.

Improved Efficiency and Accessibility: The Mason Coin offers greater efficiency in domestic and international financial transactions as a digital currency. It could also increase financial inclusion by providing access to financial services to the unbanked or underbanked.

Innovation: The central bank’s adoption of a digital currency also spur innovation in the financial sector, leading to the development of new financial products and services based around the Mason Coin.

Human resources: The high expectation of the goals is attended by the best human capital, including technological, regulatory, and security experts, ensuring that Mason Coin’s technology is robust, secure, and protected and developing regulatory frameworks for managing the digital currency.

The Rise of Digital Banking and the End of Crypto Currency - Click here

The Difference between crypto currency and Digital banking system:

Digital banking and cryptocurrency are completely different and when it comes comes to safety and security digital banking is clearly the winner. Digital banking also benefits from the regulatory frameworks and established financial institutions that govern its operations. Here are a few points to consider:

1. Regulation and accountability: Digital banking operates within a regulated framework overseen by financial authorities. Banks are required to adhere to strict security protocols, privacy laws, and customer protections. This regulatory oversight helps ensure that banks maintain high-security standards and are accountable for any breaches or issues that may arise.

2. Fraud protection: Digital banking systems typically have robust security measures to protect against fraud, such as multi-factor authentication, encryption, and fraud monitoring systems. Banks invest heavily in cybersecurity to safeguard customer data, detect suspicious activities, and prevent unauthorized access.

3. Customer support and dispute resolution: When using digital banking, customers have access to dedicated customer support channels, such as helplines or live chats, where they can seek assistance with any issues or disputes. Banks have established protocols and procedures to handle complaints and resolve disputes in a timely manner, providing an additional layer of protection for customers.

4. Backed by traditional financial systems: Digital banking operates within the existing financial infrastructure, with funds in traditional currencies held in regulated banking institutions. This means that customers have the assurance that their funds are backed by established financial systems and protected by deposit insurance schemes, which vary depending on the country.

While cryptocurrency offers certain advantages like decentralized control and potential for anonymity, it also presents some great challenges when it comes to security. Crypto currency will eventually disappear – here is why :

1. Lack of regulation: Cryptocurrencies operate independently of any central authority, which means they are not subject to the same level of regulation and oversight as traditional banking systems. This can lead to potential risks and challenges in terms of security and fraud prevention.

2. Vulnerability to hacking: Cryptocurrency exchanges and wallets have been targeted by hackers in the past, resulting in significant financial losses for individuals and organizations. The decentralized nature of cryptocurrencies makes them attractive targets for cybercriminals.

3. Irreversible transactions: Once a cryptocurrency transaction is completed, it is generally irreversible. This means that if someone makes an error or becomes a victim of fraud, it can be challenging to recover the funds.

In summary, digital banking benefits from regulatory frameworks, established financial institutions, and measures in place to protect against fraud and ensure customer security. For example DWB is a bank with a digital full banking system and is established has a central bank –

Cryptocurrencies on the other hand comes come with many risks, failures and challenges.

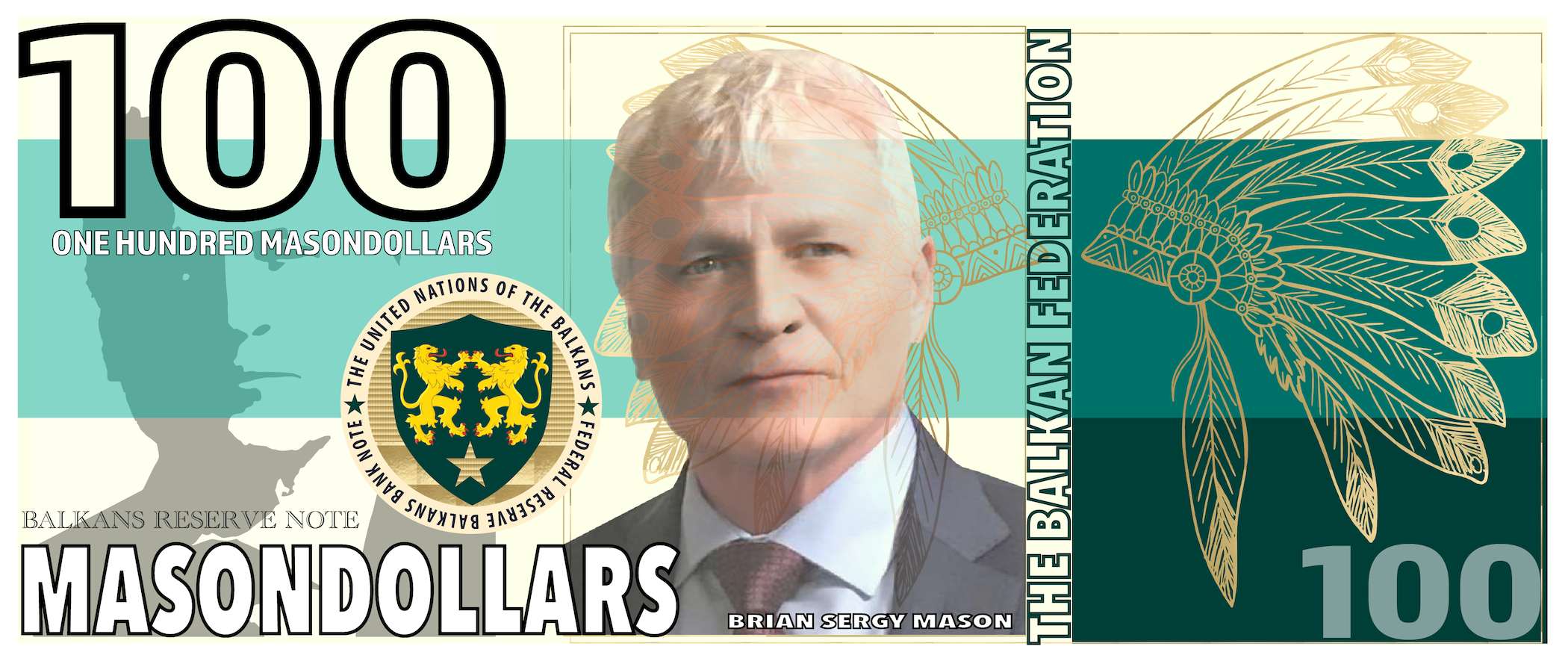

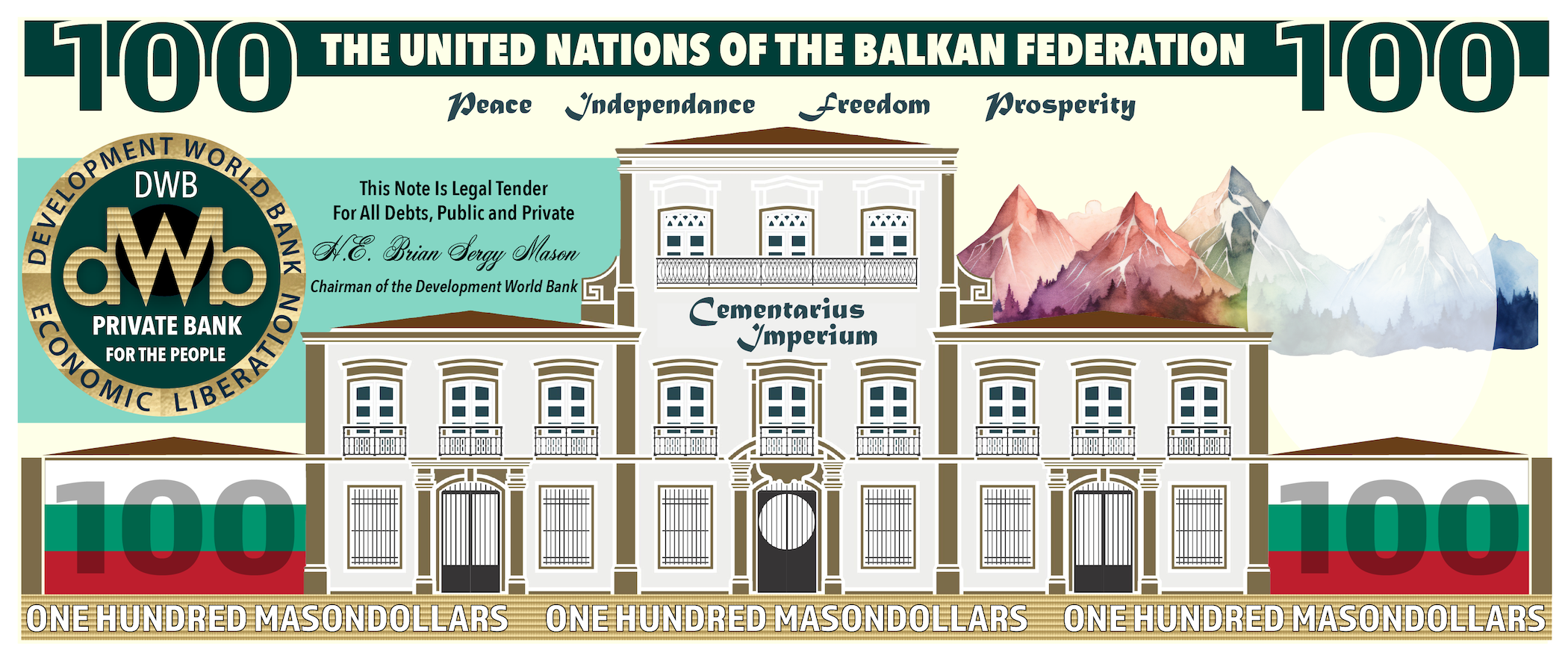

New Bank Note – The Mason Dollar

MASON COMMODITIES DIGITAL CURRENCY (MCDC)

1. MCDC plans to offer 15% of its assets, equivalent to 15,000,000 Mason Coins, for sale on the international stock exchange.

2. The Development World Bank (DWB) holds 100,000,000 MCDC coins, and their market value is determined by the coin’s purchase price, set at $50, and its performance on global coin exchanges, with sales limited to 15% of the total assets.

3. DWB Central Bank will issue notes backed by the 85% worth of MCDC coins it holds on the international market. The assets of commodities and development projects will support these notes.

4. As the Central First Digital Bank, DWB will utilize the MCDC’s value for developing Balkan Federation member nations. This will involve injecting new banknotes into the economy to fund salaries, infrastructure projects, and various initiatives for the benefit of citizens. Mason Enterprises owns DWB and manages Bulgaria’s economy and other foreign enterprises or governments linked to Balkan Federation members. The bank note’s value will be kept at 20% over the US currency and 10% Over the Euro currency.

5. The governance of Bulgaria will be overseen by the Balkan Federation’s Development World Bank. This entity operates independently and is free from external Western influences that may have been detrimental to the economies of Bulgaria and other Balkan nations. Its mission is to ensure the well-being of these countries, safeguarding them from financial, social, and authoritarian interests that seek to exert covert control over Balkan governments by providing advisors and decision-makers who mislead, deceive, and infiltrate wrong and corrupted support to the leaders of these nations.

DISCLAIMER

This is strictly a soft copy of the original Mason Dollar, containing all the security features and adding hundreds of details to the design. We have produced the enhanced or redesigned “Mason Dollar” version with advanced security features and intricate design details. Knowing legal and regulatory requirements related to this currency design and production in the Balkans jurisdiction is essential.

MCDC - The MASON DOLLAR - PDF - click here

DWB’s Markets & Economic Peace

Through the Development World Bank (DWB), the Balkan Federation is the World’s Management for Global Economic Peace. It is the only Financial Platform Alive to Liberate Africa and Restore the Humanities to Morality and Common Sense.

Invitation: African Continent & Individual Nations of Africa.

The Development world bank invites all the nations of Africa to Join the Balkan Federation for their self-economic liberation and the status of total sovereign independence under the Federation’s unconditional financial and trade support. The DWB will assist the new United Nations of Africa (UNA) with wealth and asset management for the entire profit of their populations and a “Made-in-Africa” label for establishing African technologies on location along an unbreakable trade partnership with the Balkan member nations.

President Mason’s vision to extend the Balkan Federation’s umbrella to encompass all nations of Africa, thus forming the United Nations of Africa (UNA), presents a transformative potential for the entire continent. Uniting the countries of Africa under the Balkan Federation is indeed common sense and transformative.

Self-Economic Liberation:

The DWB, backed by the federation, would assist African nations in achieving economic liberation, enabling these nations to capitalize on their resources and potential while minimizing the need for external bodies. The premise of this unification is to allow African countries to achieve economic freedom. This means optimizing the utilization of their resources, capitalizing on their potential, and reducing dependencies on foreign aid or outside entities.

Sovereign Independence:

Joining the federation under these terms would mean that African nations retain their sovereignty and independence. They would be partners in the partnership rather than subordinate entities, working together to foster mutual growth and prosperity. Each African nation would maintain its cultural mechanism even as part of the larger federation. They are equal partners within the partnership, committed to maintaining their unique identity and governance for the prosperity of their populations.

Financial and Trade Support:

The federation, through the DWB, would provide the African nations with financial and trade support, offering a robust platform for growth and development. This could encompass a range of initiatives, including infrastructure development, capacity-building programs, and the facilitation of trade agreements. The Balkan Federation, via the Development World Bank (DWB), would provide unconditional forms of participation, from funding infrastructure development to new educational structures from the member nations.

Wealth and Asset Management:

The DWB’s wealth and asset management expertise is a valuable resource for African nations, enabling them to manage and grow their wealth effectively for the benefit of their populations. The DWB’s role would also extend to support by effectively managing and increasing African nations’ wealth to benefit their communal regions directly.

“Made-in-Africa” Label :

Technological Advancement: Through the support of the federation and the DWB, African nations can work on establishing their technological innovations, fostering home-grown industries, and creating jobs. The “Made-in-Africa” label would help position African countries as producers of high-quality goods and services, thus transforming the continent’s image on the global stage. The “Made-in-Africa” Label can be placed on fostering indigenous industries and promoting initiatives boosting local manufacturing and technology sectors, putting their entire young populations to work.

Trade Partnership:

Trade partnerships with Balkan member nations could open up new markets for African goods, boosting their economies and strengthening their position in the global economy. The vision includes establishing a robust and unbreakable trade partnership with Balkan member nations. This would open up new markets for African goods and services, bolstering the member nations’ economies.

Implementing such a broad and impactful initiative requires the present leadership for strategic planning, strong leadership, efficient management, and a commitment to transparency and accountability, ultimately demonstrated by the DWB as central guiding banks to the entire Balkan Federation. This marks a significant step towards to the prosperous and equitable future for Africa.

DWB & The MARITIME Providence

Through the Development World Bank (DWB), the Balkan Federation is the World’s Management for Global Moral Awareness. It is the only Financial Platform Capable of Assembling Islands and Indigenous Nations into an Alliance of Maritime Assembly of the Marine Foundation (World Naval Federation) for Economical and Ecological Protection of our Oceans.

Invitation: Island Nations of Oceania, the Caribbean, and the Indian Ocean.

Extending an invitation to all Island Nations of Oceania, the Caribbean, and the Indian Ocean to join the Balkan Federation for mutual growth and economic development. This move encapsulates over 100 nations across the globe to be empowered by the Federation for the sovereign protection and conservation of their territory therefore committed to mutual support and shared prosperity.

President Mason’s invitation to all Island Nations of Oceania, the Caribbean, and the Indian Ocean to join the Balkan Federation is a move of significant solidarity and cooperative vision. Including over 100 nations from diverse regions of the world, the Federation has a moral responsibility toward creating a global alliance committed to mutual growth, prosperity, and sovereignty.

Mutual Growth and Economic Development:

With the support of the Balkan Federation and the Development World Bank (DWB), these island nations can anticipate substantial economic growth and development. The federation can provide financial support, facilitate trade partnerships, and foster the sharing of technology and expertise among its members.

Sovereign Protection and Territory Conservation:

The Federation, while encouraging mutual support and shared growth, also respects the sovereignty of its members. Under the protection of the Federation, the island nations can safeguard their territories while also receiving aid for conservation and sustainable development efforts.

Cultural Preservation and Exchange:

The diverse cultural heritage of these nations can be preserved and promoted within the Federation. This alliance would also encourage cultural exchange, fostering understanding, respect, and harmony among its diverse members.

Increased Global Influence:

Joining the Federation can give these smaller, often underrepresented nations a more assertive global voice. Their interests can be better represented and defended in international discussions and negotiations.

Shared Disaster Response and Climate Change Mitigation Strategies:

Given the vulnerability of island nations to natural disasters and climate change impacts, being part of the Federation allows island and coastal nations access to shared disaster response capabilities and climate change mitigation strategies.

This initiative, while ambitious, is carefully planned by the DWB, Through the strong leadership of the Balkan Federation’s humanitarian foundation (Marine Foundation), and President Mason’s commitment to mutual respect for life and economic cooperation. It promises a more integrated, resilient, and prosperous global maritime community.